This is part 2 of a three-part series on the US timber industry.

Chat history

You said:

You just summarized a document describing the collapse of the US timber industry. Are there any other industries in the US that are similarly stressed?

This conversation with AI references an earlier blog: Why Can’t I Harvest My Timber?“

ChatGPT said:

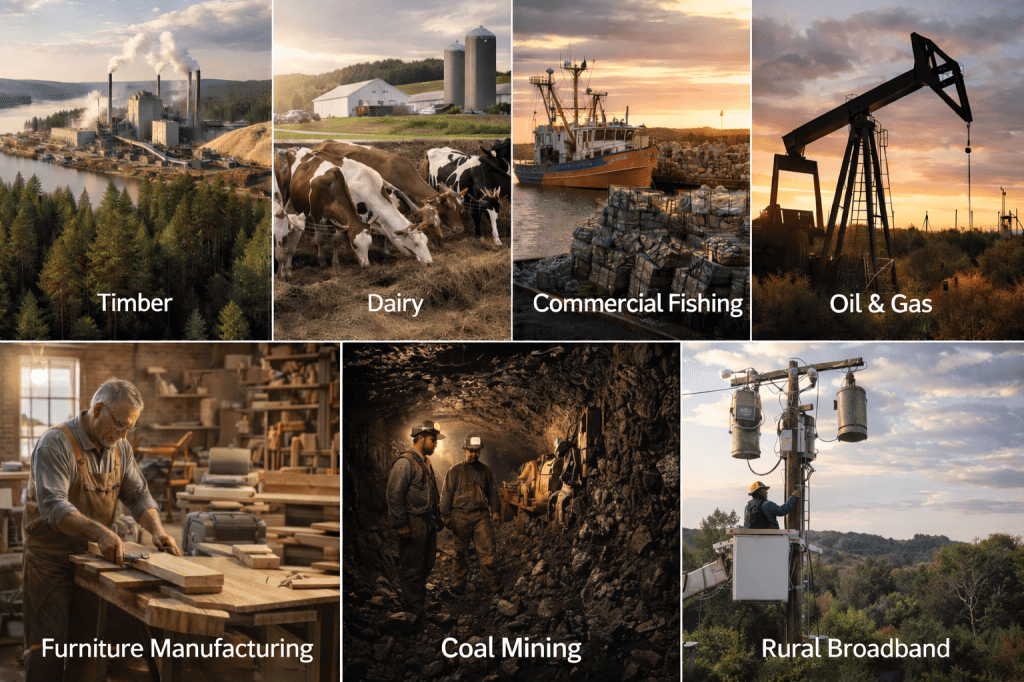

Yes. What Dougherty describes for US timber—long-term price pressure on producers caused by consolidation, globalization, policy distortions, and demand substitution—has close analogues in several other US industries. Below are the most directly comparable cases, using the same structural lenses he applies to timber (market power, supply–demand imbalance, policy effects, and globalization). I’ll explicitly anchor this to the timber analysis you shared

1. US Family Farming (Grains, Livestock, Dairy)

Why it’s similar

- Producer prices stagnate or fall while input costs rise (land, equipment, fuel, fertilizer).

- Extreme consolidation downstream (meatpackers, grain traders, dairies) limits competition.

- Farmers sell into local or regional monopsonies, much like timber growers selling to one or two mills.

Timber parallel

- Timber growers vs. pulp & paper mills

- Farmers vs. Tyson/JBS/Cargill/ADM

Key stress signals

- Farm bankruptcies despite high retail food prices

- Land appreciation masking poor operating returns

- Shift from owner-operators to leased or corporate land

Bottom line: Like timber, farming still “feeds the country,” but the economic surplus flows upward, not to producers.

2. US Commercial Fishing (Especially Small-Boat Fleets)

Why it’s similar

- Regulatory well-intentioned environmentalism constrains supply without ensuring economic viability.

- Consolidation of quotas and processing favors large players.

- Imports displace domestic catch even as fleets shrink.

Timber parallel

- “Hands-off” or poorly targeted conservation reduces economic sustainability.

- Certification and quota systems become barriers, not incentives.

Key stress signals

- Aging fleets, exit of young fishermen

- Ports losing working waterfronts

- Fish stocks may recover, but fishing communities collapse

3. US Furniture & Wood Manufacturing (Already Collapsed)

Why it’s similar

- Offshoring after NAFTA/WTO hollowed out domestic production.

- Domestic raw materials exported, finished goods re-imported.

- Loss of value-added manufacturing, not raw supply.

Timber parallel

- Logs → China → veneer furniture → US

- Pulp → Brazil → paper products → US

Key stress signals

- Former manufacturing hubs (e.g., High Point, NC) rebranded away from production

- Skilled labor permanently lost

Bottom line: This is effectively timber’s future warning, not just its past.

4. US Coal (Thermal, Not Metallurgical)

Why it’s similar

- Demand collapse driven by policy + substitution, not resource exhaustion.

- Infrastructure stranded; producers left with assets no one wants.

- Communities hollowed out faster than alternatives develop.

Timber parallel

- Pulpwood oversupply with shrinking demand

- Mills close faster than new uses (bioenergy, composites) appear

Important difference

- Timber is renewable and carbon-positive; coal is not.

- That makes timber’s neglect more economically and environmentally paradoxical.

5. US Independent Oil & Gas Producers (Conventional Fields)

Why it’s similar

- Producers are price-takers in global markets.

- Financial engineering > production economics

- Boom-bust cycles reward scale, punish stewardship.

Timber parallel

- REIT/TIMO separation from land mirrors E&P separation from midstream/refining.

- Long-rotation assets misfit quarterly financial logic.

6. US Rural Broadband & Infrastructure Providers (Co-ops, Small ISPs)

Why it’s similar

- Capital-intensive, long-payback assets

- Compete against consolidated national firms

- Policy often favors scale over resilience

Timber parallel

- Local forests vs. global supply chains

- Local infrastructure vs. global capital efficiency

Cross-Industry Pattern (This Is the Key Insight)

Across all these sectors—including timber—the same forces recur:

- Consolidation downstream

- Buyers consolidate faster than producers can.

- Global substitution

- Imports cap domestic prices even when local supply is abundant.

- Policy asymmetry

- Environmental or trade policies constrain producers but not substitutes.

- Long-cycle assets in short-cycle markets

- Forests, farms, fleets, and mines don’t align with quarterly ROI logic.

- Land value hides operating failure

- Just as Dougherty notes for timberland

pasted

, asset appreciation masks declining productive viability.

One Critical Difference: Timber Is Fixable

Unlike coal or some fisheries, timber still has enormous latent option value:

- Bio-based materials

- Engineered wood (CLT, MPP)

- Bioenergy + carbon substitution

- Local manufacturing revival

But—exactly as the paper argues—markets must exist before forests can stay forests

Leave a comment